SYDNEY (Yosefardi) – Straits Resources Ltd (SRQ) has restructured the silver prepayment facility for Gunung Muro gold-silver mine in Kalimantan, Indonesia.

The restructuring, according to SRQ chairman Andre Labuschagne, helps the company in addressing the challenge of short-term liquidity, while it implements a new operational strategy to bring its Muro gold operations to a cashflow positive position.

The restructured silver prepayment facility results in a remaining commitment of 1.5 million ounces of silver compared to 1.685 million ounces prior to the restructuring.

This is possible by closing out part of the remaining Gunung Muro gold hedge and rolling the proceeds into the silver prepayment facility. “15,062 ounces from the gold hedge has been closed out as part of the restructuring, leaving 15, 105 ounces (at a hedged price of US$1585/Oz) of the hedge in place out to the end of December 2014,” Straits said.

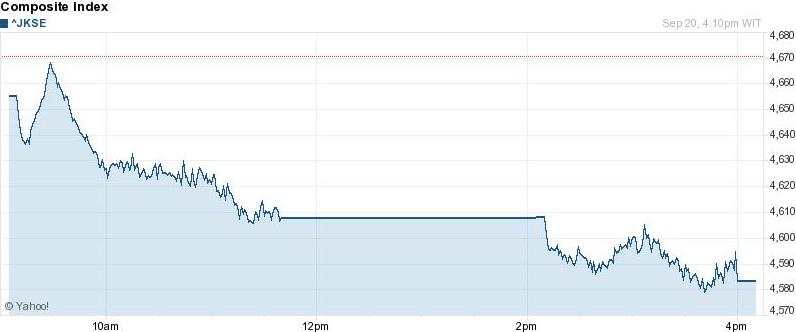

Gold price has dropped substantially to below US$1300 per ounce recently.