VANCOUVER (Yosefardi) – Barisan Gold Corporation has decided to re-initiate exploration and drilling activities at Upper Tengkereng.

After further consultation with the forestry departments at the regency and provincial level assessing relevant central government forestry maps, it has come to our attention that a material portion of the Company’s Upper Tengkereng prospect is located outside of a forest area, which in turn means that it can be explored without the issuance of a forestry borrow-use permit.

In the coming weeks, a drill rig will be mobilized to site and drilling will resume in late August after the Ramadan holiday.

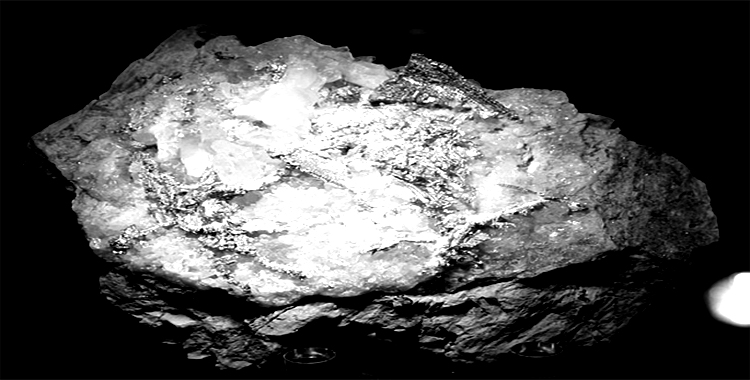

The Company plans to initially drill up to 3,000 meters that will seek to target, expand and define the high-grade zones intercepted in Hole UTD-002. Each hole will take approximately 4-6 weeks to complete with another 2-4 weeks for assaying before results are released to the market.

This exploration program will count towards the work commitment required under the Company’s exploration license.

Meanwhile, in January 2012, the Barisan Gold released an initial NI 43-101 resource for its Abong gold deposit located in the Province of Aceh, Indonesia.

Based on 130 drill holes totalling 8,660 meters, an initial resource containing 8.5 million tonnes at 1.5 g/t gold + 10.7 g/t silver was calculated by Mining Associates Pty Ltd. of Brisbane, Australia.

The Abong gold deposit is located in production forest hence is not restricted by the moratorium in force by the Indonesian Government covering primary forests.

Over the past few months, the Company has worked diligently with the various levels of governments to obtain a forestry borrow-use permit for the Abong gold deposit.

Despite strong support from the regency and provincial governments, the Company continues to wait to receive permission to proceed with its application from a local timber company who shares the surface and forestry rights at Abong.

Based on the recommendation of the regency government, the Company has decided to request a suspension of its Izin Usaha Pertambangan (IUP) at Abong while it seeks final support from the timber company. The suspension, valid for an initial 1-year period, allows the Company to protect its timetable for completion of exploration activities at Abong.

Under Indonesia’s mining law, exploration licenses (IUPs) are valid for a period of up to 7 years after which they must either be converted to mining licenses or be relinquished. By suspending its IUP, Barisan Gold guarantees that it will have enough time to complete drilling and feasibility studies prior to the end of the 7-year exploration period as suspension basically stops the clock.

As announced on March 4, 2013, the Company is in the process of selling its interest in the Collins prospect. A number of approvals have now been received from various government authorities and the closing of the transaction is expected to occur in the third quarter of 2013. The proceeds from the sale will be used towards the drilling at Upper Tengkereng.