JAKARTA (Yosefardi) – The central bank, Bank Indonesia (BI), again honed the loan-to-value ratio (LTV) and financing-to-value ratio (FTV) on housing loans, as well as downpayments on motor vehicle loans in order to stimulate the bank intermediation function while maintaining prudential principles and consumer protection.

The ratios were adjusted through the release of a new regulation, namely Bank Indonesia Regulation (PBI) No. 18/16/PBI/2016, concerning the Loan-to-Value Ratio (LTV) and Financing-to-Value Ratio (FTV) for Housing Loans as well as Downpayments on Motor Vehicle Loans (PBI LTV/FTV), effective from 29th August 2016.

Four amendments are;

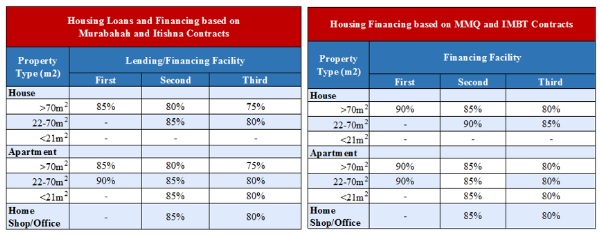

First, the ratio and tiering of housing loans and financing were changed for the 1st, 2nd and 3rd facilities.

Second, the requirements for total non-performing loans (NPL) and non-performing financing (NPF) were changed from gross to net as follows:

a. non-performing loans (NPL) to total credit or non-performing financing (NPF) to total financing must be less than 5% (net); and

b. non-performing housing loans to total housing loans or non-performing housing financing (NPF) to total financing must be less than 5% (gross).

Third, top up loans from commercial banks and new financing from Islamic banks or sharia business units for existing financing shall apply the same LTV and FTV ratios while the loans or financing remain current. The same conditions apply to take over housing loans and financing using top up loans or new financing.

Fourth, housing loans and financing for incomplete property are permitted up to the 2nd facility with phased liquidation.

The amendments to the regulations are expected to catalyse bank intermediation and drive domestic demand, thus stimulating national economic growth while maintaining macroeconomic stability.