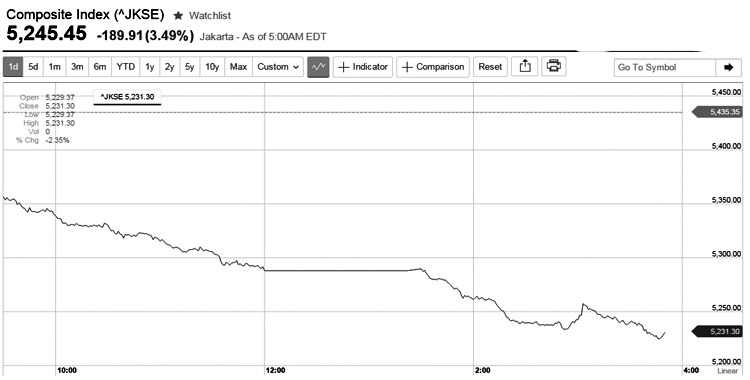

JAKARTA (Yosefardi) – Composite index of the Indonesia Stock Exchange (IDX) dropped 3.5% to close at 5245 on Monday (April 27), the lowest during the past 3 months, with concern over the economic slowdown triggeting the selling in local stocks.

Astra International lost 5.4%, Astra Agro dropped 8.98%, Bank Rakyat Indonesia shed 7.14%, Bank Negara Indonesia slashed 6.47%, and Bank Mandiri fell 5.46%.

Bumi Resources also dropped 7.69%, BW Plantation lost 6.43%, London Sumatra fell 7.24%, and Timah shed 6.7%.

Other losers were Sekawan Intipratama (-10.98%), Japfa Comfeed (-7.26%), Surya Citra Media (-6.06%), Bank Tabungan Negara (-6.06%), and Adhi Karya (-7.56%).

Some companies, such as Bank Mandiri, Astra Agro and Unilever, have released their earning results for the first quarter of this year, which mostly lower than the expectation of market analysts.

While some analysts and economists predict the national economy to grow by 5.1% to 5.2% in the first quarter of this year.

Meanwhile, technical wise, many Indonesia’s stocks have made their significant gains in the past 6 months and are considered too expensive. Then the current correction is still healthy and some investors do the shifts on their portfolios.

Nymex’s crude oil rose 0.1% to US$57.22 per barrel and gold increased 0.58% to US$1,181.80 per ounce. The rupiah strengthened to Rp12,922 against the US dollar.