JAKARTA (Yosefardi) – Composite index of the Indonesia Stock Exchange (IDX) ended down 1.27% to 5444 on Monday (March 10) with regional markets’ weaknesses prompting the selling mood in local stocks.

Asian stocks closed in red Monday after strong U.S. jobs data fanned expectations that the U.S. Federal Reserve may raise interest rates sooner than previously thought, Reuters reported.

In domestic front, Finance Ministry Bambang Brodjonegoro expects the national economy might grow by 5% in the first quarter of this year, slower growth as the state budget spending has not implemented yet as the revision of 2015 state budget was just approved by the parliament early this year.

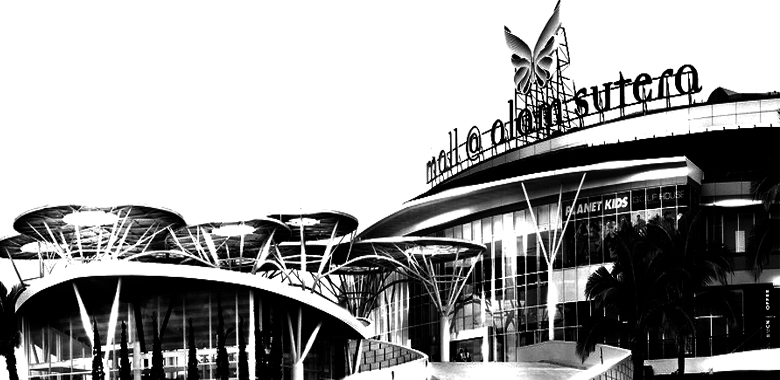

Investors focused selling property stocks. Alam Sutera dropped 4.1%, Lippo Karawaci lost 4.3%, Agung Podomoro shed 3.82%, Modernland slashed 3.64%, Intiland Development dropped 3.74%, Jababeka fell 2.87%, and Bumi Serpong Damai down 1.9%.

Other losers were Bumi Resources (-5.26%), Bank Mandiri (-2.48%), Telkom (-1.34%), Astra International (-1.55%), Bank Central Asia (-1.54%), Waskita Karya (-4.2%), and Garuda Indonesia (-3.8%).

Nymex’s crude oil rose 0.2% to US$51.58 per barrel and gold increased 0.76% to US$1,173.20 per ounce. The rupiah weakened again to Rp13,047 against the US dollar.